Article

Data templates for a smoother regulatory ride?

Introduction

EU regulation has been introduced which are designed to promote transparency, protect consumers, and encourage environmentally sustainable practices in insurance, finance and investment management. Some well known examples are:

- MIFID: To protect investors by ensuring transparency and fairness in financial markets, promote efficiency by fostering innovation and competition, and encourage responsible investment practices.

- SFDR: To enhance transparency in the financial sector by requiring disclosure of sustainability factors, empower investors by providing information for informed investment decisions, and promote sustainable finance by encouraging investment in green businesses.

- Solvency II: To strengthen the stability of the insurance sector by mandating adequate capital reserves, safeguard policyholders' interests, and enable innovation through a flexible regulatory framework.

Other examples are Basel 3 (for banking), Taxonomy and IDD.

These regulations have significantly contributed to a substantial and notable increase in the volume of data that must be disclosed and exchanged among market participants. The purpose of this data sharing is to ensure that these participants can effectively demonstrate their adherence and conformity with these regulations, thereby meeting the necessary compliance requirements.

Numerous initiatives have been undertaken to effectively manage and utilize the overwhelming amount of data available. In particular we’ll focus here on the some data standardization efforts to support EU regulation and aimed at the exchange of investments data, typically investments part of large pension funds or insurance portfolios.

FinDatEx

FinDatEx stands for Financial Data Exchange Templates. It is a joint initiative by industry associations in the European financial services sector to develop and maintain standardized templates for the exchange of data in compliance with relevant EU regulations, such as MiFID II, PRIIPs, and Solvency II. The goal of FinDatEx is to facilitate the efficient and consistent exchange of data between different stakeholders in the financial services industry, thereby improving transparency, reducing costs, and enhancing market efficiency.

Touted benefits of using FinDatEx templates:

- Improved data quality and consistency: FinDatEx templates provide a common framework for data representation, which reduces the risk of errors and inconsistencies in data exchange.

- Increased efficiency: FinDatEx templates can be used to automate the exchange of data, which can save time and money.

- Enhanced transparency: FinDatEx templates make it easier for market participants to understand and interpret data, which can improve transparency and market efficiency.

- Reduced costs: By automating the exchange of data and reducing the risk of errors, FinDatEx templates can help to reduce costs for businesses.

Templates

FinDatEx developed templates are freely available for use by all financial services firms in the EU. They are also supported by several industry associations, including Insurance Europe, the European Banking Federation (EBF), and the European Fund and Asset Management Association (EFAMA).

Specific templates that FinDatEx has developed and provided on their website are:

- European PRIIPs Template (EPT): This template is used to disclose key information about packaged retail investment products (PRIIPs) to investors.

- European ESG Template (EET): This template is used to disclose information about environmental, social, and governance (ESG) risks and factors to investors.

- European MiFID Template (EMT): This template is used to disclose information about financial products to potential investors.

- Solvency II Tripartite Template (TPT): This template is used to exchange portfolio composition information between asset managers and insurers.

FinDatEx is indeed a valuable resource for financial services firms in the EU. By using FinDatEx templates, businesses can improve their data quality, efficiency, transparency, and cost-effectiveness. They can also help to comply with relevant EU regulations and promote market stability and confidence.

Conclusion

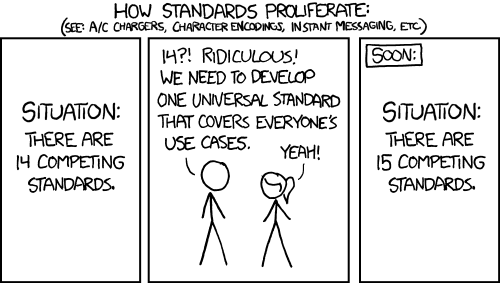

FinDatEx and the templates they develop have been a significant driver in harmonising data exchange and play an important role in facilitating the smooth flow of information. However, it is important to note that templates are not a panacea for all data exchange challenges. While there has been notable progress, there are still some key problems that need to be addressed.

One of these issues is the voluntary nature of participation, which can lead to inconsistencies and gaps in the data exchange process.

The technical delivery methods used to exchange data may vary across different organisations, platforms and systems, making it difficult to ensure seamless integration.

Lastly, the internal semantics used within standards are not standardized, which can create confusion and hinder effective communication.

It is essential for stakeholders to work towards finding solutions to these challenges in order to maximize the potential benefits of standards and achieve a more efficient and streamlined data exchange ecosystem.

So how do you successfully navigate these challenges and apply technology to harmonize data:

- Find champions in your company that are going to lead the way forwards.

- Start small, learn and plan to implement the technology in other processes.

- Finally, get a technology vendor on board that understands technology AND your business.

At Mesoica have developed smart software and processes that can help you navigate these challenges effectively and support in leveraging these standards better.

Mesoica’s data quality platform is specifically designed to help LPs and GPs manage their data efficiently. By using our platform, you can seamlessly collect, validate, and monitor data, enhancing communication and collaboration. Our scalable solution adapts to your organization's growing data needs, providing peace of mind and enabling you to become a truly data-driven organization. Start your journey today by visiting our website or contacting us to learn more about how Mesoica can empower your firm to continuously improve data quality.